Cell and gene therapies (CGTs) are generating seismic shifts in the pharmaceutical landscape by offering disease-targeting, potentially curative solutions. In recent decades, cell and gene therapy has developed from a hypothesis to a life-saving reality. This holds immense promise for previously untreatable conditions like cancers (especially blood cancers), rare genetic diseases (such as haemophilia, Duchenne muscular dystrophy, Fabry disease, and β-thalassemia), and neurodegenerative disorders (like Alzheimer’s and Parkinson’s disease).

Cellular products encompass cancer vaccines, cellular immunotherapies, and various autologous and allogeneic cell types for specific therapeutic purposes, such as adult and embryonic stem cells and hematopoietic stem cells. Using cells to treat illnesses by interfering at the cellular level as opposed to the genetic one is known as cell therapy. Because they can generate a variety of cell types to restore the damaged tissue, stem cells are frequently used in cell therapy. The body’s cells must be replenished on a regular basis; yet, because certain tissues, like blood, have a fast turnover rate, transplanting healthy tissue would only be a short-term fix. It is possible to replace the damaged tissue with new, healthy tissue if the defective cells are effectively replaced with healthy ones. Cells from a healthy donor or the patient’s own cells may be used in cell therapy.

Human gene therapy aims to change a gene’s expression or the biological characteristics of living cells in order to be utilised therapeutically. The procedure of gene therapy is intricate. Scientists must be able to pinpoint the precise gene that causes the illness and know just how to attack it. There is no one “gene therapy” that can be used to cure genetic problems, just as there is no one kind of surgery. Numerous mutations might cause a certain disease, which means that while gene therapy can treat some subtypes of the condition, there are others that cannot be treated. Hence, these therapies are more often referred to as ‘Precision medicines’.

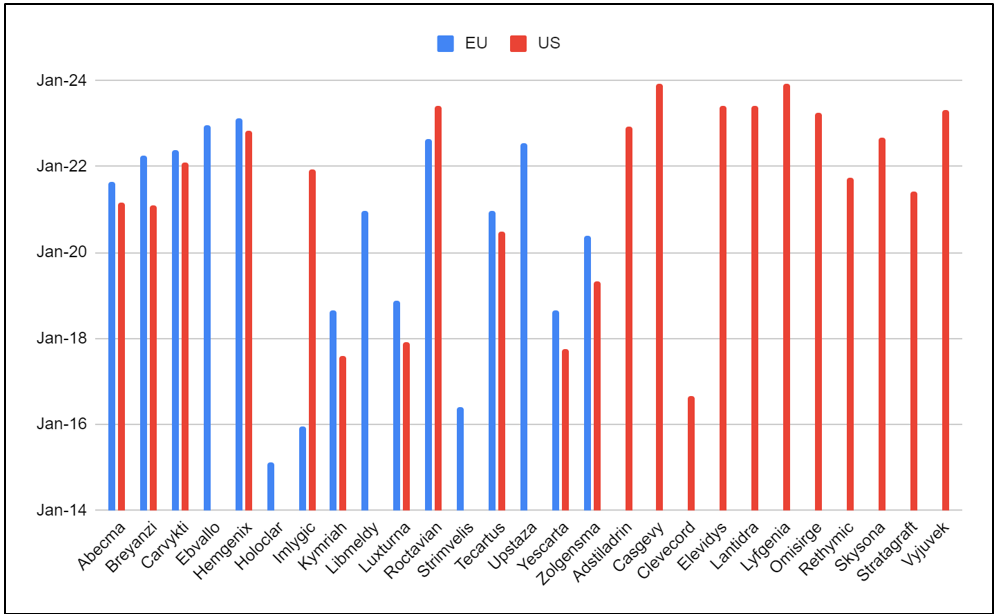

As of February 16, 2024, over 80 cell and gene therapies have been approved globally, with regional variations. The figure below depicts the number of CGTs approved in the EU and the US market:

Figure 1: CGT product approvals in the EU and the US

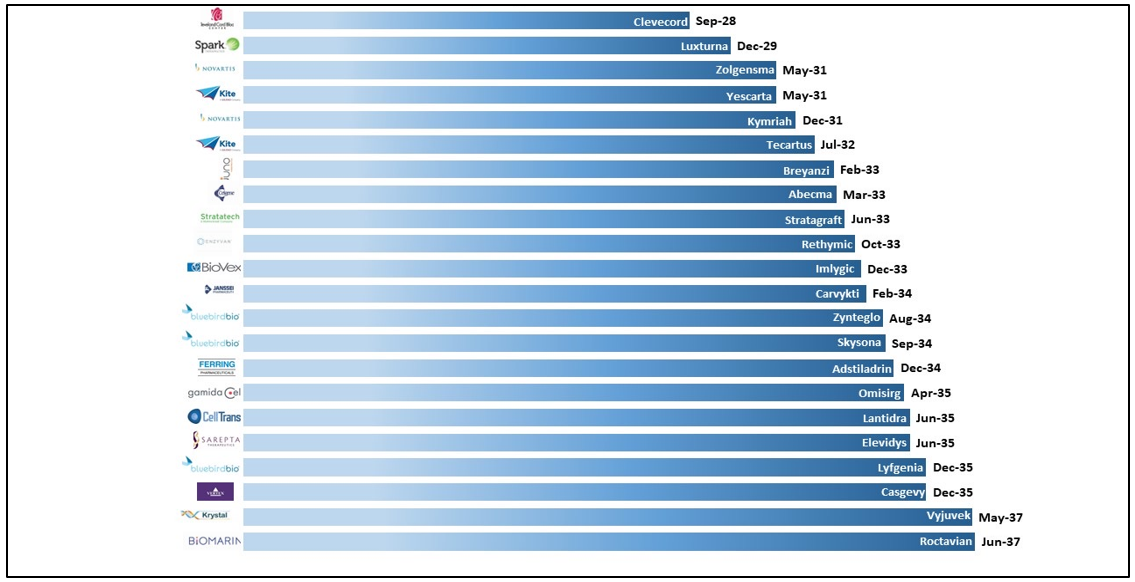

The price structure of the CGTs appears to be a major issue – it is way beyond any imagination of affordability. CGTs come with a huge development cost and a small size of target population. Since the market of these products is limited to an infinitesimal number compared to other biological products, the recoupment of the manufacturing cost takes gene therapies out of the reach of everyone. In the US, the loss of protection (LOP) of these approved CGTs ranges from 2028 to as far as 2037. Between 2030 and 2035, we will witness the first wave of cell and gene therapies lose market exclusivity when most biosimilar companies enter the field, just as happened with antibody-based biosimilars. The product-wise LOEs can be seen in the figure below:

Figure 2: Loss of protection of CGT products that are approved by the USFDA

Gene and cell therapy development will become cheaper as more CDMOs come together to meet the high demand for manufacturing services. The economies of scale will further bring down manufacturing costs. The regulatory requirements will also become more rational as the FDA develops confidence, no different than what it did with therapeutic protein biosimilars.

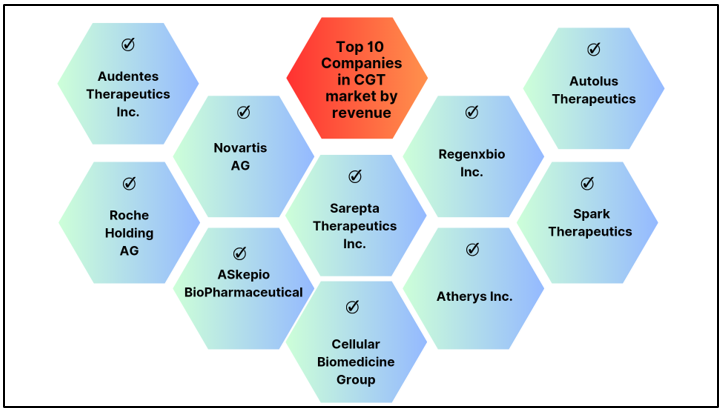

Companies like Novartis, Kite Pharma, Roche, Spark Therapeutics, and Bluebird Bio lead the charge, but the field is teaming with innovation from players like Editas Medicine and CRISPR Therapeutics. These smaller companies often focus on specific niche diseases or cutting-edge gene editing techniques, injecting diversity, and dynamism.

The top 10 players by revenue in this space are:

Figure 3: Top 10 players by revenue in the CGT space

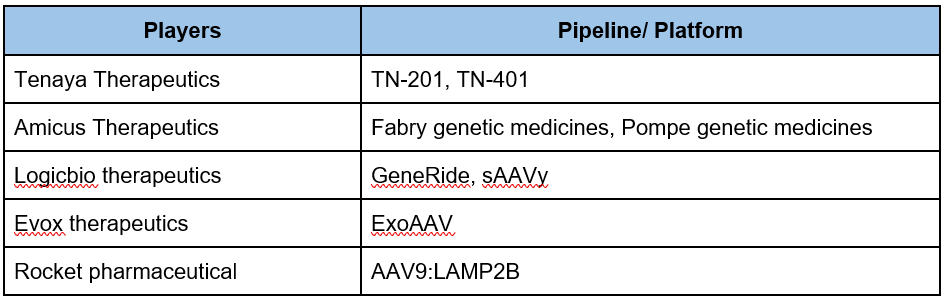

There are a lot of small players that are currently very active in this space. These can be easily identified with the patent landscape of CGTs. Some of these small players are as below:

Table 1: Some key small players in the CGT area along with their pipeline/ technologies

A lot of CGT pipelines are being developed with the help of universities and specialised centres. Some of the top universities and centres in this area are University Oxford innovation, UAB Barcelona, IIT Kanpur, Kuopio centre for cell and gene therapy, Cornell university, Texas University, and more.

The past few years have also witnessed a lot of mergers, acquisitions, and collaborations in this space. Some of the notable ones are:

- Regeneron and 2seventy bio

- AbbVie and Umoja Biopharma

- Precision BioSciences and Iaso/Umoja Biopharm

- Novartis and Voyager Therapeutics Inc.

- MaxCyte, Inc. and Lion TCR

- 4D Molecular Therapeutics and Arbor Biotechnologies

- AstraZeneca and Gracell Biotechnologies

- Vertex Pharmaceuticals and RoslinCT, Ascle Therapeutics and Porton Advanced

- AstraZeneca and Neogene Therapeutics

- Orgenesis Inc. and Savicell

While manufacturing complexity, high costs, supply chain, and associated cytokine release syndromes remain hurdles in the development and approval of CGTs, their unwavering potential to revolutionize treatment paradigms in complex diseases is undeniable. With continued research and development, we can expect even more breakthroughs in the years to come, offering hope for millions battling intractable diseases.

References: